USD/CHF: US Dollar jumps off lows as Fed retain positive economic outlook

- The US macro data came out mixed, but the St. Louis Fed president was optimistic about the outlook for the US growth and inflation.

- The key risk event for the US Dollar is Jerome Powell’s first Congressional testimony on Tuesday.

The USD/CHF is trading virtually unchanged on Monday at around 0.9371 after it has fallen to a session low of 0.9325 earlier in Asia. The London session saw the US Dollar buyers taking control and drive the FX market back up, supported by the optimistic outlook for the US economy and inflation from Fed’s regional president.

While the employment rise in Switzerland was reported in line with expectations earlier on Monday, the US macro data came out mixed with new home sales falling -7.8% instead missing the expectations of 3.2% increase. The decisive role has been played by St. Lous Fed president James Bullard that was overly optimistic on the US economy and inflation while speaking in Washington.

Fed Governor Randal Quarles is scheduled to deliver a speech titled "An Assessment of the US Economy" at the National Association of Business Economics policy conference, in Washington at 20:15 GMT.

The key risk event for the US dollar this week is the Federal Reserve chairman Jerome Powell Congressional testimony due on Tuesday with the text of the testimony being released 90 minutes before the testimony begins at 13:30 GMT.

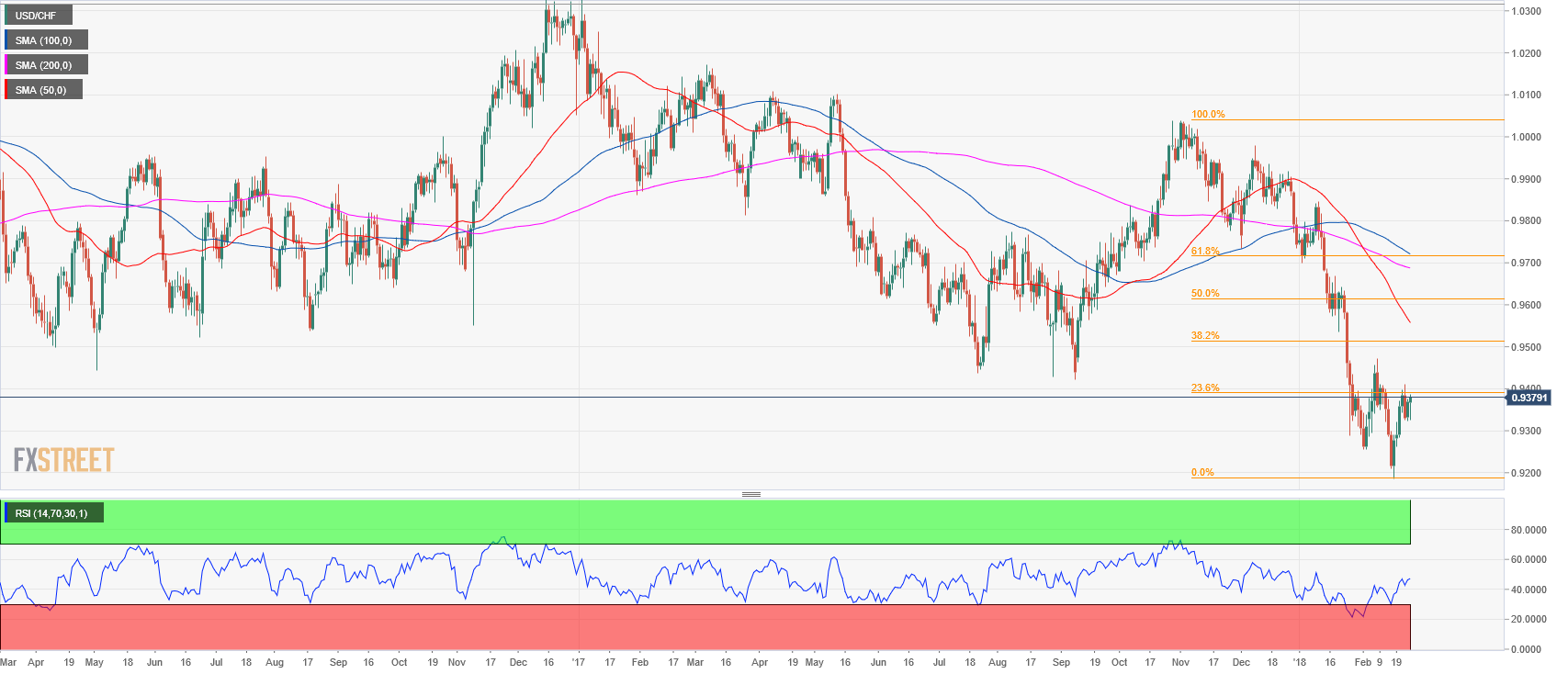

After rebounding sharply from the 0.9200 level, the next resistance for USD/CHF is seen at 0.9400 figure and 23.6% Fibonacci retracement. Next key resistance is seen at the 0.9500 big figure and 38.2% Fibonacci retracement level.

To the downside, support is seen at the 0.9300 handle and at 0.9200 cyclical low.

USDCHF 1-hour chart