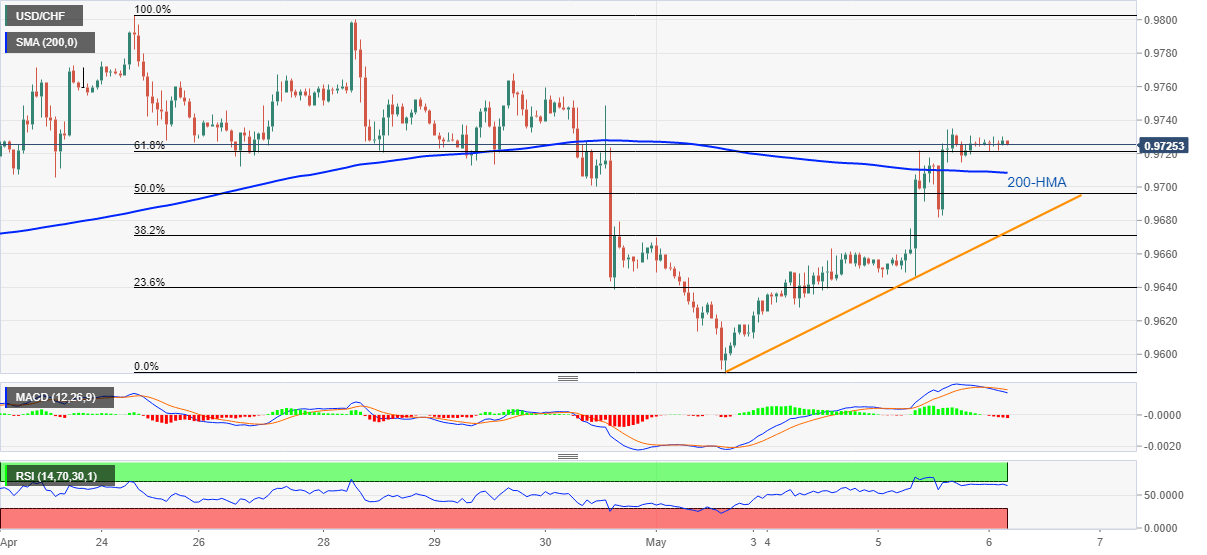

USD/CHF Price Analysis: Bearish MACD checks buyers above 61.8% Fibonacci retracement

- USD/CHF struggles for direction after clearing key upside barriers, now supports.

- Overbought RSI conditions limit upside beyond 0.9735.

A sustained break of 200-HMA and key Fibonacci retracement fails to propel USD/CHF moves as it remains mostly unchanged around 0.9725 ahead of Wednesday’s European session.

The reason could be spotted in overbought RSI and bearish MACD. As a result, sellers look for entry below 200-HMA level of 0.9708. However, 61.8% Fibonacci retracement of April 24-May 01 fall, near 0.9720, acts as the immediate support.

During the pair’s declines below 0.9708, the monthly support line around 0.9675 can lure the bears.

On the upside, 0.9735 restricts the further advances to 0.9770 and 0.9800 round-figure. It should also be noted that a sustained run-up beyond 0.9800 enables the bulls to aim for the March month top surrounding 0.9900.

USD/CHF hourly chart

Trend: Pullback expected